On September 9, 2025, Walmart stunned the African retail sector by announcing its first-ever branded stores in South Africa, set to open before December 31, 2025. The move, revealed in Johannesburg, marks a pivotal shift for the U.S. retail giant—not just expanding its footprint, but finally putting its iconic name on the door after years of operating behind the scenes through its majority-owned subsidiary, Massmart Holdings Limited. The announcement didn’t just signal a new chapter for Walmart—it ignited conversations across townships and shopping malls about price, culture, and who really benefits from global retail’s arrival.

From Shadow Player to Spotlight Brand

Walmart has owned a controlling stake in Massmart since 2011, quietly shaping the South African grocery landscape through brands like Game, Makro, and Builder’s Warehouse. But now, it’s stepping out of the shadows. The decision to launch under the Walmart banner isn’t just branding—it’s a strategic bet that the global recognition of the Walmart name, paired with its famed Every Day Low Price philosophy, can cut through market saturation and win over skeptical consumers."We’re not just opening stores," said Kath McLay, Walmart International President and CEO. "We’re building trust, one shelf at a time. And that means celebrating South Africa’s culture—not just selling to it."

The Africa Growth Summit: The Secret Catalyst

Behind the scenes, the groundwork was laid months earlier. In April 2025, Walmart hosted its inaugural Africa Growth Summit in Johannesburg, bringing together suppliers from 12 African countries. The summit wasn’t a photo op—it was a sourcing engine. Dozens of small and medium-sized businesses, from Cape Town-based textile makers to Lusaka-based food processors, walked away with formal contracts. These suppliers will now stock Walmart’s shelves, a move that could reshape local manufacturing ecosystems."We didn’t just want to import goods," explained Miles Van Rensburg, Massmart president and CEO. "We wanted to build relationships. That’s why we’re working directly with entrepreneurs across the continent. It’s not charity—it’s smart business. When local producers thrive, our customers win."

What’s on the Shelves? And Who’s Hiring?

The stores will carry a full range: fresh produce, household cleaners, electronics, apparel, and home goods—all under one roof. Think Walmart Supercenter, but with African flair. Local brands will share space with global names like Procter & Gamble and Unilever. The layout? Bright, wide aisles, friendly service. And yes, digital integration is coming—though details remain under wraps. Could be扫码支付, mobile checkout, or AI-driven inventory systems. No one’s saying yet.What’s clear: hiring will be local. Thousands of jobs are expected, from cashiers to logistics managers. And unlike past foreign retail entries that imported management, Walmart says it’s training South Africans to lead. "Our associates are our brand ambassadors," Van Rensburg added. "They’ll shape how customers feel walking in."

Community First: Three Pillars, One Mission

Walmart didn’t just bring products—it brought a promise. Three community investment pillars were announced: economic mobility programs for women entrepreneurs, food security initiatives targeting schools and clinics, and sustainable supply chain projects reducing plastic and waste. These aren’t PR stunts. They mirror Walmart’s global community strategy, but tailored. In Limpopo, for example, a pilot program will train 500 women to supply fresh vegetables directly to Walmart stores. In Durban, a recycling partnership with local NGOs will turn plastic waste into store shelving."This is about legacy," said McLay. "Not just quarterly sales. Can we help a single mother in Soweto afford diapers and rice on the same paycheck? That’s the metric that matters."

What’s Next? October Holds the Keys

The big unknown? Locations. The announcement confirmed stores are under development across the country—but no cities, no neighborhoods. That changes in October 2025, when Walmart will reveal exactly where the first five stores will open. Analysts suspect Gauteng and Western Cape will lead, but informal settlements like Khayelitsha or Mdantsane could be surprise picks, given the focus on inclusive growth.By November, hiring drives will begin. Community forums will be held in each target area. And by December, the first Walmart sign will go up—bright red, unmistakable, and, for many, a symbol of both opportunity and anxiety.

Why This Matters Beyond South Africa

Walmart’s move isn’t just about selling more cereal. It’s a signal to other global retailers: Africa isn’t a fringe market anymore. If Walmart—known for its ruthless efficiency and supply chain mastery—believes it can win here, others will follow. This could trigger a wave of foreign investment in African retail, with ripple effects in logistics, agriculture, and manufacturing.But it’s not without risk. South Africans have seen foreign brands come and go. The real test? Will Walmart deliver on its promises of low prices without undercutting local suppliers? Will it pay living wages? Will its digital tools work for customers without smartphones? The answers will shape not just Walmart’s future in Africa—but the continent’s retail destiny.

Frequently Asked Questions

Why is Walmart opening stores now, after 14 years of owning Massmart?

Walmart’s ownership of Massmart gave it market access, but not brand recognition. The April 2025 Africa Growth Summit connected Walmart directly with 12 African suppliers, proving local sourcing could scale. The company now believes its global brand, combined with local partnerships, can outperform Massmart’s existing labels in value perception—especially among middle-income shoppers seeking trusted names.

Will Walmart’s prices really be lower than existing retailers?

Walmart claims its "Every Day Low Price" model will undercut competitors by 10–15% on comparable goods, based on its global scale and supply chain efficiency. But analysts warn that logistics costs in South Africa’s rural areas may limit savings. Early comparisons show Walmart’s projected prices will be competitive in urban centers, but rural access remains uncertain without distribution hubs.

How many stores are planned, and where?

Walmart has confirmed at least five stores will open by year-end, with plans for 15–20 by 2027. Locations remain undisclosed until October 2025, but industry sources suggest Johannesburg, Cape Town, Durban, Pretoria, and Port Elizabeth are frontrunners. The company is reportedly evaluating high-footfall areas near public transport hubs and informal settlements to align with its community inclusion goals.

What’s different about Walmart’s approach compared to other foreign retailers?

Unlike past entrants who imported management and products, Walmart is prioritizing local sourcing (12 African countries already contracted), hiring locally for leadership roles, and tying community programs directly to store locations. It’s also integrating digital tools designed for African mobile usage patterns—something competitors like Amazon or Carrefour haven’t yet replicated at scale in the region.

Could this trigger job losses at Massmart stores?

Walmart insists there will be no forced layoffs. Massmart stores will continue operating as-is, while Walmart opens new locations. However, some analysts fear brand overlap could cannibalize sales, leading to eventual consolidation. The company has pledged to retrain Massmart staff for Walmart roles, but no formal transition plan has been published yet.

What impact could this have on African suppliers?

The direct supplier partnerships from the Africa Growth Summit could be transformative. Over 200 small businesses secured contracts to supply goods like textiles, packaged foods, and home goods. If Walmart maintains these relationships, it could create a new export pipeline for African SMEs, bypassing traditional middlemen and increasing margins. But long-term success depends on Walmart’s willingness to pay fairly and on time—something that’s still untested.

Posts Comments

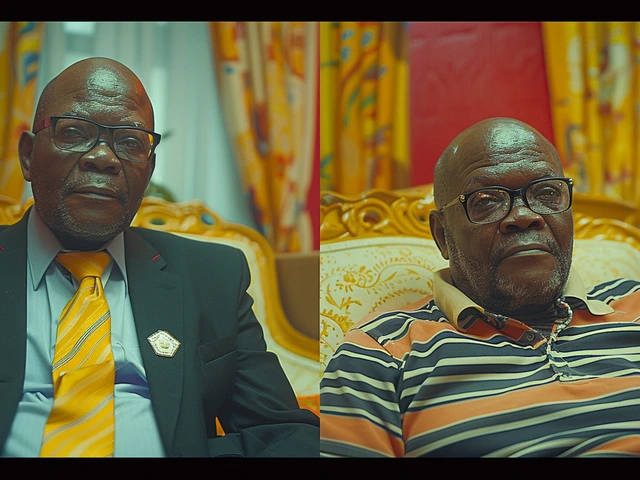

Samba Alassane Thiam November 2, 2025 AT 10:34

So Walmart’s finally showing its face? Took long enough. Hope they bring real prices and not just ‘Every Day Low’ stickers on overpriced junk.

Carolette Wright November 3, 2025 AT 20:55

OMG I’m so excited!! I love Walmart!! Can we get their snacks here?? I miss their chips and soda!!

Beverley Fisher November 5, 2025 AT 12:26

This is just so heartwarming!! I can’t wait to see the smiling faces of the employees and all the local moms getting their groceries on sale!! ❤️

Patrick Scheuerer November 6, 2025 AT 19:01

The romanticization of corporate expansion under the guise of ‘community empowerment’ is a predictable narrative. Walmart’s supply chain efficiency is not altruism-it is capital optimization. The invocation of ‘trust, one shelf at a time’ is a rhetorical device designed to obscure the historical pattern of retail colonialism in emerging markets. One does not build legacy by lowering prices while extracting surplus value from local producers. The real metric is not whether a mother can afford diapers, but whether the structural conditions enabling her poverty have been addressed-or merely masked by discount optics.

Angie Ponce November 8, 2025 AT 06:53

Of course they’re ‘partnering’ with local suppliers. That’s how they avoid tariffs and get tax breaks. They’ll squeeze every cent out of those small businesses and then shut down when the margins dip. This isn’t inclusion-it’s exploitation dressed in sustainability buzzwords.

Andrew Malick November 8, 2025 AT 13:53

Let’s not confuse scale with sustainability. Walmart’s model works in the U.S. because of infrastructure, logistics density, and wage suppression. South Africa’s transport costs, energy instability, and informal economy make this a high-risk experiment. The ‘Every Day Low Price’ promise will collapse at the first supply chain hiccup. And if they can’t get refrigeration to rural areas, then ‘food security’ is just a marketing slide.

will haley November 9, 2025 AT 02:54

Imagine if they open a store next to my uncle’s spaza shop… he’s gonna cry. I’m already emotional just thinking about it.

Laura Hordern November 9, 2025 AT 08:15

You know, I’ve been to South Africa a few times and I just love how vibrant the markets are-the colors, the music, the way people haggle over tomatoes like it’s a sport. I hope Walmart doesn’t sterilize all that. I mean, I get they want efficiency, but part of what makes shopping there special is the human connection. I hope they keep the banter, the laughter, the way the lady at the fruit stall remembers your kid’s name. That’s the soul of it. Don’t turn it into a Target.

Brittany Vacca November 9, 2025 AT 22:34

This is so exciting!! I hope they have good customer service!! I heard some stores in the US are so nice!! I can’t wait to see the photos!! 😊

Lucille Nowakoski November 10, 2025 AT 06:20

I really hope Walmart takes this opportunity to really listen to local communities. Not just say they care, but actually sit down with women’s co-ops, ask what they need, and build from there. This could be a real chance to lift people up, not just sell to them. Let’s make sure they follow through.

Benjamin Gottlieb November 12, 2025 AT 04:44

Walmart’s entry into South Africa represents a convergence of neoliberal globalization and postcolonial economic repositioning. The strategic deployment of localized supplier networks-while ostensibly empowering SMEs-is in fact a form of embedded extraction, wherein value chains are reconfigured to optimize for shareholder yield under the ideological veneer of inclusive capitalism. The ‘community pillars’ function as symbolic capital, legitimizing market penetration while deferring structural accountability. The true litmus test lies not in wage levels or plastic reduction, but in whether ownership of logistics infrastructure, procurement algorithms, and digital payment ecosystems remains in local hands-or becomes another node in an American-controlled global retail matrix.

Angela Harris November 12, 2025 AT 05:15

Interesting. I wonder how the cashiers will handle the power outages.

Doloris Lance November 13, 2025 AT 23:28

They’re not ‘training locals to lead’-they’re training them to be cheap labor under a foreign brand. This isn’t development, it’s corporate imperialism with a smiley logo.

Anita Aikhionbare November 14, 2025 AT 20:14

Walmart? In Africa? This is not progress. This is cultural erasure. We have our own businesses, our own markets. Why do we need a giant American corporation to tell us what to buy? They’ll drive out local traders and then raise prices when they have a monopoly. Don’t be fooled by their ‘low prices’-it’s a trap.

Mark Burns November 16, 2025 AT 13:17

So basically, Walmart’s coming to take our jobs, our culture, and our tomatoes? I’m already crying into my instant noodles.

jen barratt November 17, 2025 AT 08:26

I think this could actually be good if they do it right. Like, imagine if the women in Limpopo really get to sell their veggies directly and make a fair wage. That’s the kind of thing that changes lives. But it’s a big if. Hope they keep their word.

Evelyn Djuwidja November 17, 2025 AT 09:39

This is yet another example of American corporations imposing their business model on sovereign nations under the guise of ‘economic development.’ South Africa does not need Walmart. It needs investment in its own entrepreneurs-not foreign domination dressed as philanthropy.

Alex Braha Stoll November 19, 2025 AT 01:03

Man, I used to work at a Walmart back home. The managers were nice, but the schedule was a nightmare. Hope they treat their staff better here. If they don’t, it’s gonna blow up.

Samba Alassane Thiam November 19, 2025 AT 16:19

And now they’re hiring locals? Sure. And then when the quarterly numbers dip, they’ll ‘restructure’ and replace them with robots. Seen this movie before.

Write a comment